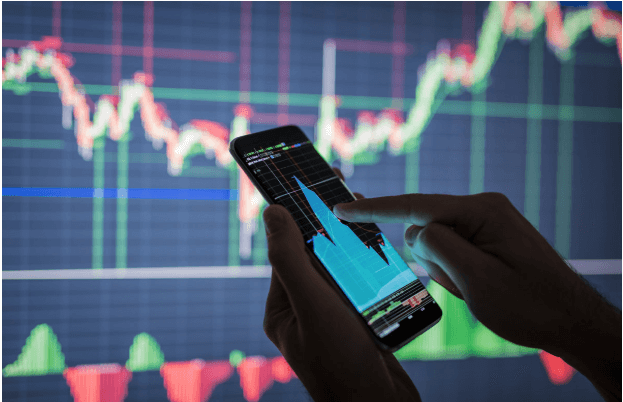

Investors, if they are day traders at home or managers of large hedge funds, are data hungry. They pore over earnings and company filings and jump to read news alerts. If they're on the super-sophisticated side, they can be using data models. And if they're on the cutting edge, they may be using new 'alternative' data sets to inform their decisions.

The emerging alternative is one of the most important types of financial services in the world.

It's no wonder spending on alternative data is poised to grow. Research firm Tabb Group expected to reach $ 400 million by 2021, and Daryl Smith, CFA Director of Research and Alternative Data firm NeuData wrote in February, 'We believe that, much like 2017, 2018 will be a period of substantial growth in alternative data adoption among investment managers. '

High-flying data alternatives

The mobile location data and insights are available here. How's this alternative? When it's a company that compiles and analyzes alternative data sets, it has a new corporate aviation intelligence product called FlightSight that monitors corporate aircraft ownership of publicly-traded and private companies and their flights to more than 25,000 destinations.

Why would an investor want to track corporate air travel? Well, as the company explains, 'you can not find a destination for your destination, or stay in the destination of your destination.' find out if there are multiple Walmart corporate flights between Bentonville and London in a given period, and factor that information into decisions.

When the Chief Data Officer Abraham Thomas described today's alternative datasets as 'the' boots on the ground 'of the digital age.' Insights derived from sources as varied as satellite imagery for predicting oil inventories or insurance records for gauging auto sales, he said, are 'Merely the descendants of methods known and used in the investment community for decades.'

Retail stock insights

Let's say you're an investor eyeing retail stocks. In May, Dollar General (NYSE: DG), Tangier Factory Outlet Centers (NYSE: SKT), and Home Depot (NYSE: HD). 'As a real estate investment trust (REIT) that focuses on the US and Canada, Tanger Factory Outlet Centers may be looking for 'retail' stocks to buy,' noted Motley Fool. 'But Tangier is uniquely located to weather retail-industry headwinds even as many traditional brick-and-mortar retailers fail.'

This suggestion might pique the interest of a hedge fund manager. From there, she may be looking into the company's recent quarterly earnings reports. She'd like to know that the company's CEO is in the Q1 2018 earnings call that Tangier has adopted its 2018 guidance, noting, 'We are also facing the challenge of the first quarter of the year. higher than anticipated unreimbursed snow removal costs and center closures, which resulted in lower variable rents. '

Of course, keeping abreast of the weather in key Tangier markets would have provided valuable insight for any investor. However, there is alternative data that adds nuance when monitoring the health of a retailer.

For example, UberMedia has been rated as one of the most popular events in the world. We are looking at this year's memorial day weekend data compared to last year's teased out fascinating insights.

For instance, among the Tanger Outlets, we're in the middle of this year, but we're in the middle of the day. A few, but not far from the city of Grand Rapids, MI, Glendale, AZ and outlets in Houston, San Marcos, and Terrell, TX. It's important to note that Houston consumers - and possibly those in San Marcos and Terrell - are still recovering from the hurricane. The results in Grand Rapids and Glendale may have been less anticipated by investors.

What alternative data such as mobile rental visit data can offer insights about certain retail locations in places that have not experienced major weather events or economic downturn, information that investors can access before earnings reports come out.

The new parking lot photo

Today's novel data indicators, as Abraham Thomas of Quandl suggests, are more advanced versions of data collected for decades. For example, companies have provided data-obsessed investors with information derived from primitive parking lot photos or satellite photo data for decades, the idea being to use the number of cars in a retailer's lot. If it is more likely that sales are higher, then it is likely that sales will be higher.

Mobile rental data is the modern version of the parking lot photo. The number of mobile devices spotted in specific retail locations indicates which markets are most likely to be used. Mobile rental data providers feed anonymized foot traffic information into sophisticated data models used by consultancies, investment firms or retailers themselves. Not only does this information provide immense value from an operational and marketing standpoint, it can give investors a leg up they never had before.

At this early stage, we can only guess at the value of alternative data for investors and others with their eye on businesses. I look forward to exploring this unique business.

This article first appeared on CIO and was written by Gladys Kong and can be found here.